Investing in banknotes, often referred to as paper currency, is a niche but growing area of numismatics—the study or collection of currency, including coins, tokens, paper money, and related objects. While many people collect banknotes purely for their historical and aesthetic value, others view them as a potential investment, similar to investing in art, antiques, or coins. This article explores the concept of banknote investment, including its benefits, risks, and strategies for those interested in exploring this unique market.

**Understanding Banknote Investment**

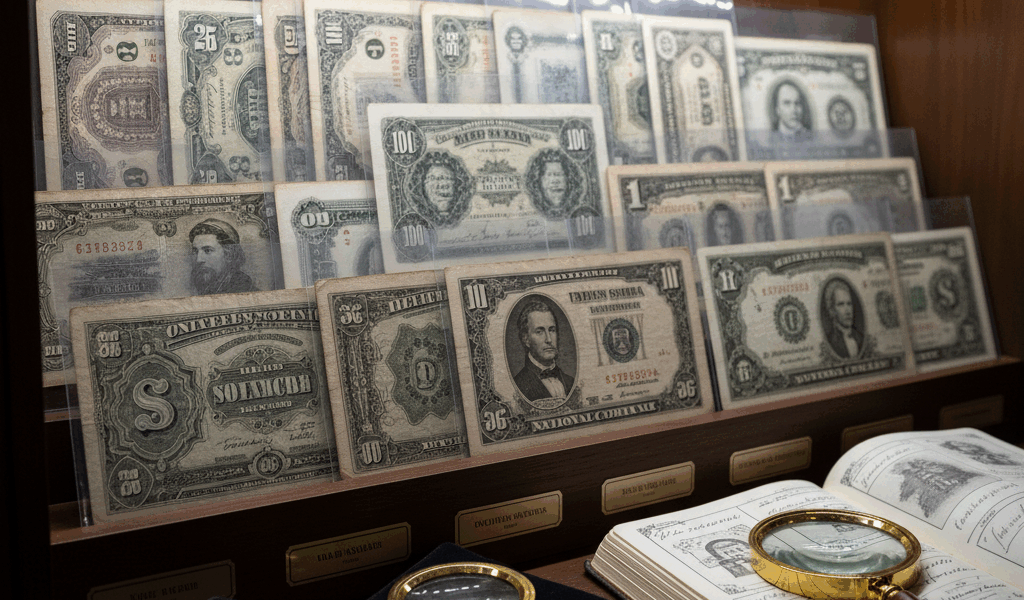

Banknote investing involves purchasing rare and valuable paper currencies with the expectation that their value will increase over time. The value of a banknote is determined by several factors including its rarity, historical significance, demand among collectors, and condition. Unlike stocks or bonds, banknotes do not generate income through dividends or interest. Instead, investors hope to sell them at a higher price than they were purchased.

**Types of Banknotes to Invest In**

There are several categories of banknotes that attract investors:

1. **Historic Banknotes**: These are often from periods of historical significance, such as revolutionary eras or important national events.

2. **Rare Issuers**: Banknotes issued by countries that no longer exist or from small issuances by obscure nations.

3. **Error Notes**: Misprints or errors in the printing process can make these banknotes highly desirable.

4. **Specimen Notes**: These are sample banknotes used by banks for educational or promotional purposes, usually marked with a ‘specimen’ notation and not intended for circulation.

5. **Serial Number Patterns**: Banknotes with unique or low serial numbers, or interesting number patterns like ladders (123456) or radars (123321).

**Benefits of Banknote Investment**

Investing in banknotes can offer several advantages:

– **Historical Connection**: Each banknote is a piece of history, offering a tangible connection to past events and cultures.

– **Aesthetic Appeal**: Many collectors appreciate the artistry of banknotes, including their intricate designs and craftsmanship.

– **Portfolio Diversification**: Adding non-traditional investments like banknotes can diversify an investment portfolio, potentially reducing risk.

– **Potential for Appreciation**: Particularly rare or sought-after banknotes can appreciate in value, offering significant returns on investment.

**Risks of Banknote Investment**

Like any investment, there are risks associated with banknote collecting:

– **Market Fluctuations**: The value of banknotes can be volatile, influenced by economic factors, trends in collecting, and changes in historical interest.

– **Condition Sensitivity**: The condition of a banknote significantly impacts its value. Damage such as tears, folds, or stains can reduce a banknote’s market value.

– **Authenticity and Fraud**: Counterfeit banknotes are a serious risk, requiring investors to be vigilant and knowledgeable about verifying authenticity.

**Getting Started with Banknote Investment**

For those interested in banknote investing, here are some steps to get started:

1. **Education**: Learn about the history and characteristics of banknotes. Resources include books, collector clubs, and online forums.

2. **Networking**: Connect with other collectors and dealers. Attending coin shows, auctions, and joining numismatic societies can provide valuable insights and contacts.

3. **Start Small**: Begin by purchasing lower-value banknotes to gain experience in assessing their condition and understanding market values.

4. **Focus on Quality**: It is generally better to invest in a few high-quality pieces than a larger number of lesser-quality items.

5. **Secure Storage**: Proper storage is critical to preserving the condition of banknotes. Invest in appropriate storage solutions to protect your collection from damage.

**Conclusion**

Banknote investment can be a rewarding and educational endeavor, offering both financial gains and the pleasure of collecting beautiful, historical items. However, like all investments, it requires careful consideration, knowledge, and planning. With the right approach, investing in banknotes can be a fascinating addition to any investment portfolio, combining the joys of collecting with the potential for financial reward.