Selling currency has gotten complicated with all the auction hype and dealer lowballing flying around. As someone who has watched collectors navigate both paths for years, I learned everything there is to know about which approach actually puts more money in your pocket. Today, I will share it all with you.

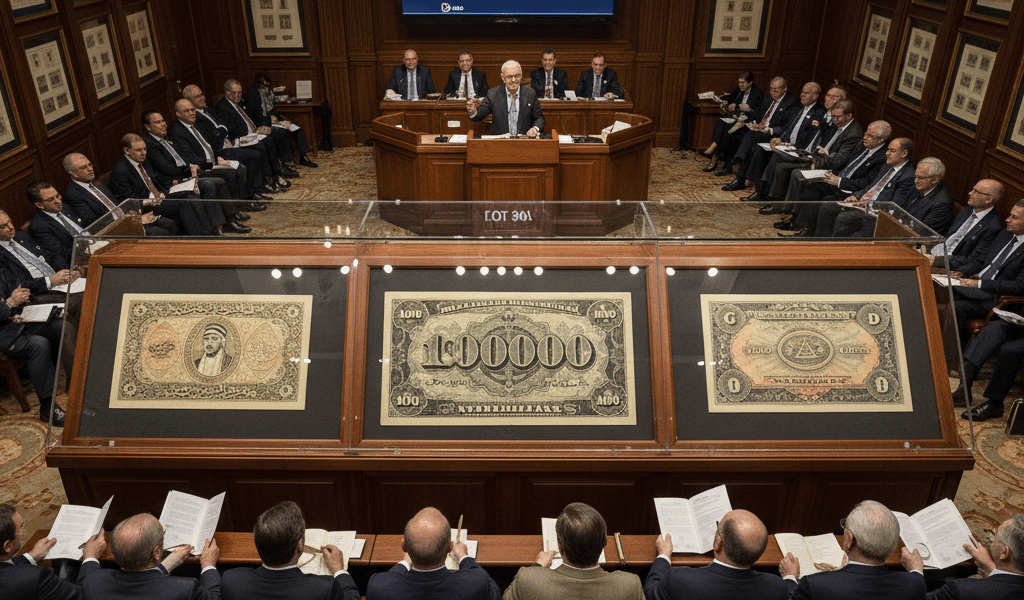

Auction House Sales

Major houses like Heritage, Stack’s Bowers, and Lyn Knight reach maximum collector audiences. Their catalogs, marketing, and customer bases expose your notes to serious buyers worldwide. For significant material, that exposure means competitive bidding and strong prices.

The costs hurt though. Seller commissions typically run 10-15% of hammer price. Photography fees, insurance, and cataloging costs pile on. Buyer’s premiums (20-25%) come from buyers but affect what they’ll bid. All-in costs might reduce net proceeds by 25-35% compared to hammer prices.

Timeline stretches months. Consignment, photography, cataloging, auction scheduling, and settlement create 3-6 month waits between consigning and receiving payment. If you need money now, auctions don’t deliver.

When Auctions Excel

Probably should have led with this section, honestly. Rare and high-value notes justify auction costs. A $10,000 note at Heritage might hammer at $12,000 thanks to competitive bidding, netting $10,000+ after fees. That same note sold to a dealer might bring $6,000-7,000 immediately. Auction exposure created $3,000+ in additional value.

Exceptional quality attracts auction premiums. Choice Uncirculated examples of desirable types generate collector competition. When multiple bidders want the finest known example, prices exceed retail estimates. Dealers can’t replicate that competitive dynamic.

Collections with strong provenance or assembled sets benefit from auction presentation. A complete type set sells better at auction than piecemeal dealer sales because collectors appreciate assembled groupings.

Dealer Purchases

Dealers buy wholesale to profit on retail resale. Typical offers range 50-70% of retail, depending on marketability, the dealer’s inventory needs, and your negotiating position. Sounds like a steep discount, but context matters.

Immediate payment has real value. Cash today beats auction proceeds in six months. Time value of money, elimination of uncertainty, freedom from ongoing process management—all worth something.

Transaction simplicity appeals to many sellers. No photography, cataloging, waiting for dates, or settlement delays. Show the material, negotiate, receive payment, walk away. If you value your time, that efficiency matters.

When Dealers Make Sense

Common material doesn’t justify auction costs. A note worth $100 retail might hammer at $80 at auction, netting $65-70 after fees. A dealer paying $60 provides nearly the same result without months of waiting.

Large quantities of mid-range material often sell better to dealers. Auction houses can’t efficiently handle hundreds of $50-200 notes. Dealers specializing in volume purchasing absorb this material at fair wholesale prices.

Speed requirements favor dealers. Medical expenses, home purchases, debt obligations—when you need funds quickly, auction timelines don’t work.

Hybrid Approaches

That’s what makes smart selling endearing to us currency collectors—you can mix methods. Consign your finest notes to auction while selling common material to dealers. Optimize for each item’s characteristics.

Use dealers for authentication before auction. Have knowledgeable dealers evaluate your collection. Their assessments help identify which pieces warrant auction investment. Some dealers provide this service hoping to purchase what doesn’t go to auction.

Consider consignment to dealers. Some accept consignment, selling on your behalf for commission rather than purchasing outright. Provides dealer expertise and retail pricing without the wholesale discount.

Negotiating with Dealers

Get multiple offers before accepting any. Three or more evaluations reveal market pricing and identify who values your specific material most. Different dealers have different customer bases—your material might fit one perfectly while others can’t use it.

Offers vary legitimately. A dealer who just sold a similar note doesn’t need yours; one with a waiting customer will pay more. Variations reflect business circumstances, not dishonesty. Shop around.

Know your material’s value before negotiating. Catalog values, recent auction results, and dealer asking prices establish reference points. Dealers respect prepared sellers and offer better prices to those demonstrating market knowledge.

Making Your Decision

Calculate net proceeds realistically. Auction estimates aren’t guarantees—notes can sell below estimates, especially in soft markets. Apply commission rates to conservative estimates rather than wishful projections.

Factor in your time and hassle tolerance. Auction consignment requires effort—selection, shipping, follow-up, settlement tracking. Dealer sales require showing up and negotiating. Which process fits your circumstances?

Consider your ongoing collecting relationship. If you’ll continue buying from a dealer, fair transactions in both directions build valuable relationships. Squeezing maximum price from someone you want to buy from next month may not serve long-term interests.

Neither approach is universally superior. Each suits different circumstances, material, and seller priorities. Understanding both lets you choose appropriately for each selling situation.