Currency collecting has gotten complicated with all the market predictions and investment hype flying around. As someone who has tracked this hobby through multiple market cycles, I learned everything there is to know about where paper money collecting is actually headed. Today, I will share it all with you.

Market Size and Growth

The numismatic market has grown consistently for decades. Currency collecting specifically has outpaced coins in recent years—lower entry costs, visual appeal, and historical storytelling potential drive that trend. Paper money’s relative affordability compared to rare coins brings new collectors in.

Auction records show the market’s strength. Heritage Auctions reported currency totals exceeding $60 million in recent years, with individual notes breaking million-dollar barriers. Headlines like that attract media attention and pull new collectors into the hobby.

Geographic expansion matters too. Asian collectors increasingly chase American and world currency while American collectors develop interest in Asian notes. This globalization means demand from multiple regions rather than just domestic markets. The internet enables international deals that were impractical decades ago.

Generational Transition

Probably should have led with this section, honestly. Baby Boomer collectors who built major collections over 40-year careers are aging. Estate sales and health-driven liquidations release material accumulated over decades. This turnover creates both supply (collections hitting the market) and opportunity (younger collectors grabbing pieces that were previously unavailable).

Younger collectors approach collecting differently. Digital natives research online before buying, expect e-commerce convenience, and share their hobby through social media. They’re comfortable with online auctions, electronic payments, and virtual communities. Dealers and auction houses are adapting.

Motivations may be shifting. Investment potential appeals more strongly to younger collectors than previous generations. Historical connection still matters, but financial considerations increasingly influence acquisitions. Notes with demonstrated appreciation histories attract investor-minded collectors.

Technology’s Impact

Smartphone apps identify and value currency instantly now. Image recognition lets you photograph notes and get catalog identifications plus value estimates. These tools lower barriers to entry—you don’t need encyclopedic knowledge to identify what you’ve found.

Online marketplaces keep evolving. eBay established internet currency commerce; Heritage and GreatCollections refined it. Future platforms may incorporate blockchain authentication, AI-powered condition assessment, or virtual reality previewing.

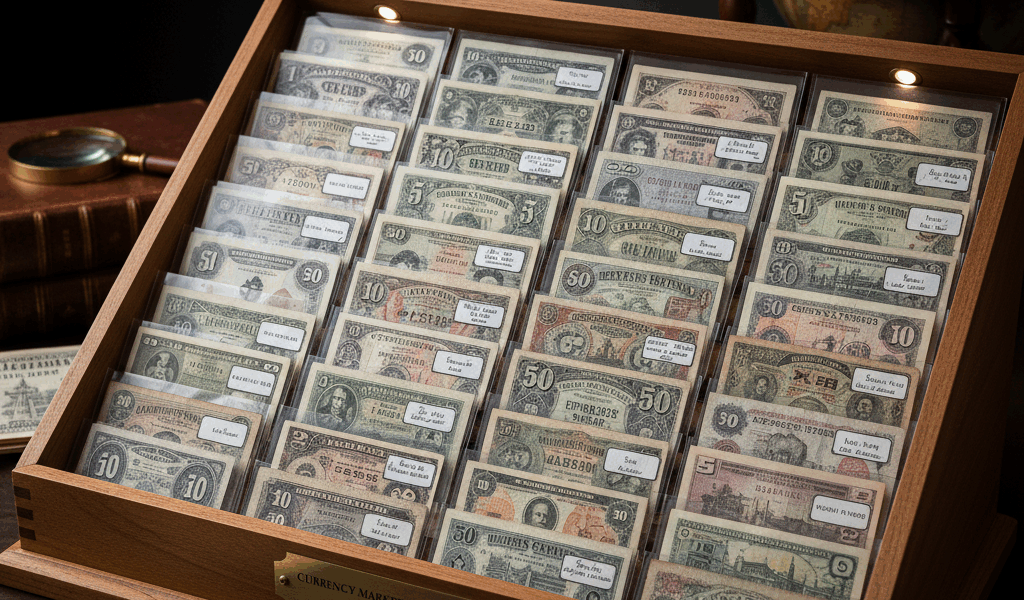

Third-party grading has become standard for significant material. PMG and PCGS Currency graded notes dominate high-value transactions. This standardization creates market efficiency—buyers trust certified grades, enabling confident remote purchasing.

Collecting Area Trends

That’s what makes error notes and fancy serials endearing to us currency collectors—they attract growing attention because they offer treasure-hunting excitement without requiring specialized historical knowledge. Social media “finds” of valuable errors spread virally, introducing non-collectors to potential value in their wallets.

World currency collecting expands steadily. Globalization exposes collectors to diverse currencies through travel, news, and digital content. Notes from emerging economies, historical political transitions, and artistically distinctive issues attract collectors wanting variety beyond American currency.

Obsolete currency—particularly National Bank Notes—benefits from regional interest. Collectors chasing hometown notes create micro-markets with strong demand for local material. This geographic specialization supports values even for notes that wouldn’t interest general collectors.

Investment Considerations

Currency has performed competitively as an alternative asset. Quality notes have appreciated steadily over long periods, though with less liquidity than stocks or bonds. Collectors seeking portfolio diversification increasingly view quality currency as a tangible asset class.

Not all currency appreciates equally. Common notes in average condition barely keep pace with inflation. Rare notes in exceptional condition significantly outperform. Investment-minded collectors should focus on quality and genuine scarcity rather than volume.

Market cycles affect values. Economic downturns sometimes reduce collector spending; recoveries often spark renewed acquisition. Understanding these cycles helps timing major purchases or sales. Patient collectors buy during soft markets and sell during strong ones.

Challenges Ahead

Physical cash faces pressure from digital payments. If paper money eventually disappears from daily commerce, will collecting interest persist? Historical precedent suggests yes—collectors pursue obsolete objects from coins to stamps to vintage technology. Currency’s historical significance may outlive its practical use.

Authentication concerns grow with counterfeiting sophistication. Advanced printing technology enables fakes that fool casual examination. Third-party grading provides protection, but collectors must stay vigilant. The market may eventually require certification for all significant transactions.

Knowledge preservation matters as experts age. Deep expertise in specialized areas exists in few hands. Documenting that knowledge before it’s lost ensures future collectors can identify and appreciate material correctly.

Positioning for the Future

Focus on quality over quantity. Fewer exceptional notes outperform many average pieces. Market trends favor the best examples of any type while devaluing common material. Build collections around outstanding pieces rather than filling gaps with inferior examples.

Embrace technology without abandoning fundamentals. Use digital tools for research and transactions while maintaining direct knowledge of your specialty. Technology assists but doesn’t replace understanding. The most successful collectors combine new tools with traditional expertise.

Participate in the collecting community. Clubs, shows, and online forums connect you with fellow collectors and current market information. These connections provide opportunities, education, and the social satisfaction that makes collecting rewarding beyond financial returns.

Currency collecting’s future looks solid. The hobby keeps attracting new participants while retaining long-term enthusiasts. Whether you’re starting out or have collected for decades, the market’s trajectory suggests continued opportunity for those who approach it thoughtfully.