Estate planning for currency collections has gotten complicated with all the conflicting advice and legal considerations flying around. As someone who has watched collectors’ heirs make devastating mistakes, I learned everything there is to know about protecting your collection’s value after you’re gone. Today, I will share it all with you.

The Problem with Unprepared Heirs

Most non-collectors can’t tell valuable notes from common ones. To untrained eyes, all old money looks approximately the same. Your $5,000 National Bank Note and your $50 large-size note appear equally “old” to someone who doesn’t know the difference.

This knowledge gap creates exploitation opportunities. Unscrupulous buyers target estate sales, offering lowball amounts for collections they recognize as valuable. Heirs lacking expertise can’t evaluate offers. They might accept $20,000 for a collection worth $100,000, grateful someone “helped” them.

Even honest buyers paying fair wholesale leave significant value behind. A dealer offering 50-60% of retail for immediate purchase is being reasonable—that’s standard practice. But heirs who understand retail value might choose different liquidation approaches.

Documentation as Legacy

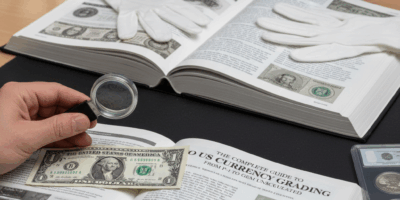

Probably should have led with this section, honestly. Create a comprehensive inventory while you’re alive to do it. List every significant note with descriptions, catalog numbers, grades, and values. Include purchase records where available. This documentation helps heirs understand what they’re handling.

Explain the collection’s organization. If you’ve arranged notes by type, date, or catalog number, document that system. Heirs who understand organization can maintain it during sales, presenting the collection coherently rather than as random accumulation.

Identify the best pieces explicitly. A note saying “the 1882 $50 National Bank Note from First National of Smalltown is the collection’s most valuable piece—estimated value $15,000” prevents heirs from selling it for $500 to someone who asks “what’s your best price for this old fifty?”

Designating Knowledgeable Help

Identify people who can advise your heirs. Collecting friend, trusted dealer, professional appraiser—whoever can help. Provide contact information and introductions while you’re alive. When the time comes, heirs have someone to call immediately.

Have preliminary conversations with these advisors. Explain your collection, your wishes for disposition, and your relationship with heirs. Advisors who understand the situation in advance help more effectively than those learning everything during crisis moments.

Professional appraisers provide independent valuations useful for estate settlement and heir education. Appraisals cost money but establish defensible values for probate while showing heirs what the collection is actually worth.

Sale Method Guidance

That’s what makes sale method guidance endearing to us currency collectors—different methods suit different circumstances. Major auction houses maximize value for significant collections but require time and charge substantial commissions. Dealers provide immediate liquidity at wholesale. Private sales capture retail but require knowledge and effort.

Provide specific guidance. “For notes worth over $1,000, consider Heritage Auctions” gives direction. “Dealer Bob Smith has offered to purchase the entire collection—call him for a fair wholesale offer” provides a trusted immediate option.

Warn against common mistakes. “Don’t sell to the first person who shows up at an estate sale” prevents exploitation. “Get at least three offers before selling anything valuable” encourages price discovery.

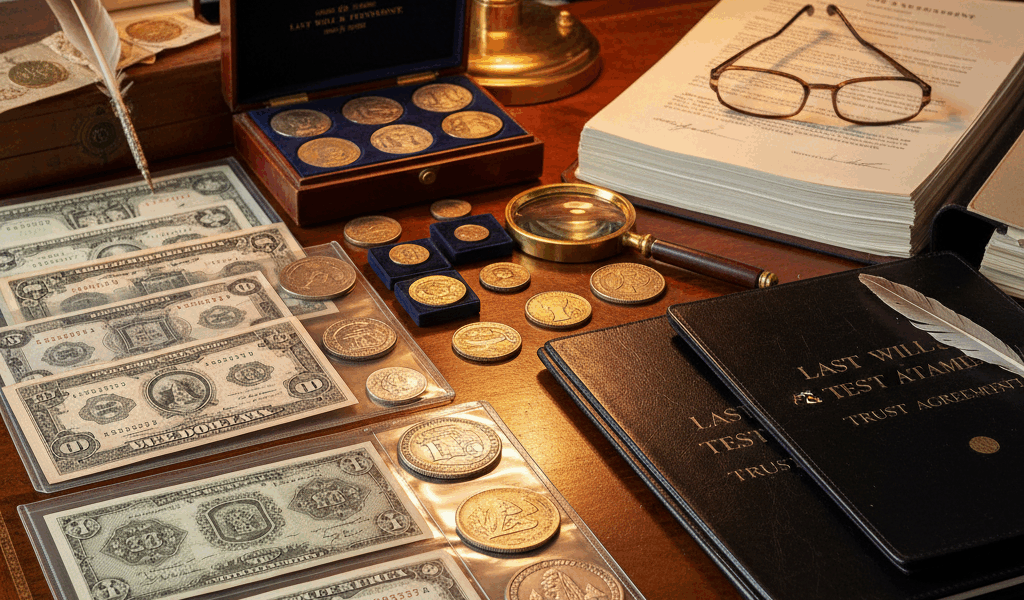

Legal and Financial Structures

Include the collection in estate planning documents. Currency collections are property requiring explicit handling in wills and trusts. Vague provisions like “divide my belongings equally” create disputes when one heir wants the collection and others want cash.

Consider specific bequests for significant pieces. Leaving a meaningful note to a grandchild who expressed interest creates personal legacy while simplifying administration. Just ensure remaining heirs receive comparable value from other assets.

Understand tax implications. Collectibles receive different treatment than other assets. Capital gains face higher rates than general investments. Estate tax valuations require documentation. Consult professionals about structuring transfers optimally.

The Conversation with Heirs

Talk to your heirs about the collection while you’re alive. This conversation might feel awkward, but it prevents confusion later. Heirs who know a collection exists, understand approximate value, and have instructions are far better positioned than those discovering everything after death.

Gauge interest in continuing the collection. If an heir shows genuine interest, consider mentoring them. Teaching them about currency creates succession—a living legacy rather than liquidation.

Be realistic about heir capabilities. Expecting non-collector heirs to maximize value through patient sales may be unreasonable. They have lives, jobs, limited time. Instructions should match what heirs can realistically accomplish.

Alternative Approaches

Sell the collection yourself if circumstances suggest problems. Converting to cash before death simplifies administration and ensures you receive appropriate value. Cash transfers to heirs more easily than specialized property.

Consider donation to museums or educational institutions. Significant collections may have historical value beyond monetary worth. Donations provide tax benefits while ensuring preservation. Not every collection must be sold—some deserve institutional homes.

Your currency collection represents years of knowledge, effort, and resources. Proper estate planning ensures that investment benefits your heirs rather than opportunistic buyers. Take time now to protect what you’ve built.