The Most Expensive Coin in the World

I’ve spent more hours than I should admit reading about record-breaking coin sales. There’s something mesmerizing about objects the size of a quarter selling for more than houses – more than entire neighborhoods, really. And when it comes to the absolute pinnacle of numismatic value, one coin keeps appearing at the top.

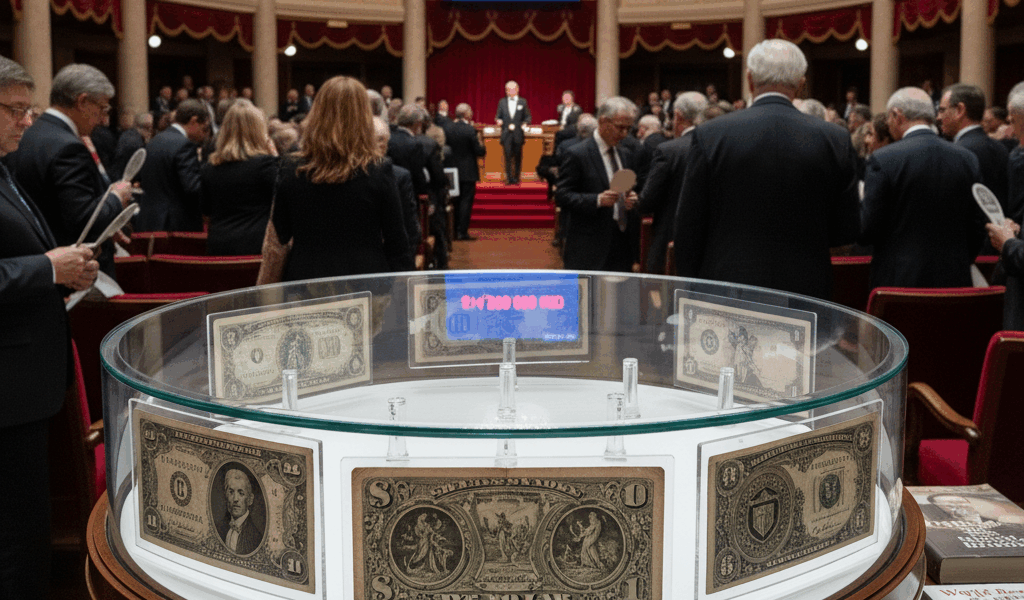

The 1933 Saint-Gaudens Double Eagle

The 1933 Saint-Gaudens Double Eagle holds the record, and its story reads like a thriller novel. Augustus Saint-Gaudens, one of America’s greatest sculptors, designed this twenty-dollar gold piece at the request of Theodore Roosevelt himself. Roosevelt wanted American coins to rival ancient Greek masterpieces. Saint-Gaudens delivered.

The Mint produced 445,500 of these coins in 1933. None were ever supposed to reach the public. The country was abandoning the gold standard, and all 1933 Double Eagles were destined for the melting pot. But twenty coins escaped. How they got out remains somewhat murky, involving suspected theft and certainly illegal possession.

The Flight of the Double Eagles

For decades, the Secret Service hunted these coins. Finding one in your possession meant federal agents at your door and probable confiscation. Nine surfaced in the 1940s and were seized. Most people assumed that was the end of the story.

Then one more appeared – this one with an unusual history. It had belonged to King Farouk of Egypt, making its ownership legally complicated. After years of negotiation, the government agreed to let this single coin be sold legally, splitting proceeds with the owner. In 2002, it sold for $7.59 million, setting a record that stood for years.

Probably should have mentioned this earlier – additional 1933 Double Eagles surfaced later, leading to more legal battles. The coin’s story keeps generating new chapters.

Why Are Coins So Highly Prized?

The 1933 Double Eagle perfectly illustrates what creates numismatic value. Rarity matters – there’s essentially one legally ownable example. Beauty matters – the Saint-Gaudens design is genuinely stunning. And story matters – this coin’s journey through theft, royal collections, and government pursuit adds intrigue that pure metal value can’t match.

Historical significance elevates value beyond material worth. A coin that witnessed important events or passed through notable hands carries weight beyond its weight in gold. Collectors pay for those connections to history.

The Market for Rare Coins

High-value coins attract both collectors and investors. Some see them as alternative assets, hedges against economic uncertainty. Others simply want to own the best examples of numismatic art. Both groups push prices upward for truly exceptional pieces.

The 1804 Silver Dollar operates similarly – produced under mysterious circumstances decades after its supposed date, existing in perhaps fifteen examples, commanding prices in the millions when they appear. Rarity plus mystery equals premium pricing.

The Unique Appeal of the Saint-Gaudens Design

Augustus Saint-Gaudens died before seeing his design reach final production, but his vision transformed American coinage. Lady Liberty strides forward carrying a torch and olive branch, the Capitol dome visible behind her. The reverse shows a flying eagle that seems genuinely in motion. It’s dynamic art compressed onto a small metal circle.

Collectors often rank it as the most beautiful American coin ever produced. That artistic merit adds to collectibility. You’re not just buying gold and rarity – you’re buying a masterpiece that happens to be portable.

Understanding Coin Grading

When millions of dollars ride on condition, grading becomes crucial. The Sheldon scale runs from P-1 (barely identifiable as a coin) to MS-70 (perfect, flawless). Most collectors never encounter anything above MS-65 or so. The difference between adjacent grades can represent substantial money for valuable coins.

I’ve made grading mistakes – overestimating coins I owned, underestimating problems that reduced value. Professional grading services exist precisely because accurate assessment requires expertise most of us don’t possess.

Legal Battles over Rare Coins

The 1933 Double Eagle saga involved decades of legal uncertainty. The government’s position was clear: all these coins were federal property, illegally removed from the Mint. Possessors argued various defenses, mostly unsuccessfully.

This legal dimension affects collectibility. A coin with clear, documented legal ownership sells for more than one with questionable provenance. The single legally sanctioned 1933 Double Eagle commanded its record price partly because ownership was finally, definitively settled.

Economic Implications of Rare Coins

When record-breaking coins sell, ripples spread through the market. Similar coins see increased interest. Collectors reassess what they own. Investment money flows toward numismatics. A single spectacular sale can shift market dynamics for years.

Some sophisticated investors include rare coins in diversified portfolios, treating them like art or other collectible assets. The coins don’t generate income, but they can appreciate substantially over time. For the right pieces in the right conditions, returns have been impressive.

Collecting Coins: Passion or Investment?

I’ve never resolved this tension in my own thinking. Part of me collects because I genuinely love handling historical objects and learning their stories. Part of me pays attention to market values and potential appreciation. Most serious collectors probably experience something similar.

The 1933 Double Eagle satisfies both impulses. It’s historically fascinating, artistically beautiful, and financially valuable. That combination creates the kind of desire that pushes prices into record territory.

International Interest in U.S. Coins

American coins attract global collectors. The Double Eagle’s journey through Egyptian royal possession illustrates this international appeal. Major auction results draw bidders from multiple continents. The stories these coins tell transcend national boundaries.

That global market means more potential buyers for exceptional pieces, pushing prices higher than a purely domestic market might support. American numismatic history belongs to the world.

The Human Story Behind Coins

Every rare coin carries human narratives. The 1933 Double Eagle involves Mint employees, government agents, royalty, dealers, lawyers, and collectors spanning ninety years. Those intersecting stories create value that transcends metal and design.

When you hold a significant coin, you’re touching something that passed through many hands, witnessed events, survived circumstances that destroyed similar pieces. That connection to human experience is what makes numismatics more than just asset accumulation.

Recommended Collecting Supplies

Coin Collection Book Holder Album – $9.99

312 pockets for coins of all sizes.

20x Magnifier Jewelry Loupe – $13.99

Essential tool for examining coins and stamps.

As an Amazon Associate, we earn from qualifying purchases.