The Maldivian Currency: An In-Depth Look

I have a small collection of world currencies I’ve picked up over the years, and my Maldivian notes always catch visitors’ attention. There’s something about currency from island nations – they tend to be more colorful, more imaginative somehow. The Maldivian Rufiyaa definitely fits that pattern, and learning its story has given me a new appreciation for how small nations assert their identity through money.

History of the Maldivian Rufiyaa

The history here actually goes back further than most people realize. Before the modern Rufiyaa, the Maldives used currency called Larin – twisted pieces of metal that originated in the Persian Gulf. I find it fascinating how trade routes shaped local currencies for centuries before anyone thought about national identity.

The name “Rufiyaa” itself traces to the Rupiya coins used in India during Sher Shah Suri’s reign. When the Maldives gained independence from British rule in 1947, they initially used the Maldivian rupee. The switch to Rufiyaa happened in 1981, a deliberate move to establish a distinct financial identity. Probably should have led with this – the currency represents national pride as much as economic function.

Coins and Banknotes

The breakdown is pretty standard: coins come in denominations from 1 Laari (basically like a cent) up to 2 Rufiyaa. But here’s the thing – those smaller Laari coins are increasingly rare in practice. Day-to-day transactions typically round to the nearest Rufiyaa.

Banknotes range from 5 to 1,000 Rufiyaa, and they’re where things get visually interesting. The designs have evolved over the years, becoming more vibrant and incorporating more sophisticated security features. Each series tells part of the Maldivian story.

Design and Security Features

I was surprised to learn the Maldives adopted polymer notes. It makes practical sense for an island nation – paper money doesn’t last long in humid, salty conditions. The polymer notes can handle getting wet, which happens pretty regularly when your entire country is surrounded by ocean.

The designs themselves celebrate what makes the Maldives distinctive: natural beauty, marine life, cultural elements. Security features include holograms, watermarks, and see-through registers that make counterfeiting genuinely difficult. For a small nation, they’ve invested seriously in currency security.

Central Bank and Monetary Policy

The Maldives Monetary Authority (MMA) handles everything currency-related. Established in 1981 alongside the Rufiyaa itself, the MMA took over from the old Currency Board system. Their job is balancing stability with the unique challenges of a small, import-dependent economy.

What strikes me about their approach is how they have to manage contradictory pressures. They need stable exchange rates for imports (the country imports almost everything), but they also need flexibility to respond to economic shocks. It’s a tightrope walk, and they’ve generally managed it well.

Exchange Rate Dynamics

Here’s where it gets interesting. The Rufiyaa is pegged to the US dollar, which provides stability but limits flexibility. For a tourism-dependent economy, this creates specific patterns. When tourism booms, foreign exchange floods in. When it slumps, things get tight.

The MMA intervenes regularly to maintain the peg, buying and selling foreign currency as needed. It’s an active management style necessitated by the Maldives’ economic structure. Without tourism revenue, maintaining the exchange rate would be essentially impossible.

Tourism and Currency

Tourism doesn’t just influence Maldivian currency – it dominates the entire economy. When you visit a resort, you’re probably paying in US dollars, not Rufiyaa. This dual-currency reality is just how things work there.

I’ve heard from travelers that you barely need local currency unless you’re shopping in Male or visiting local islands. The tourist economy runs on dollars while the local economy runs on Rufiyaa. It’s a pragmatic arrangement that keeps both sectors functioning smoothly.

Everyday Use and Practices

For residents, Rufiyaa handles most daily transactions. ATMs dispense local currency, and shops accept it without question. But the dollar is never far away, especially in tourist-adjacent businesses.

Mobile banking and digital payments have grown rapidly. The Maldives has leapfrogged some development stages, going straight to smartphone-based transactions. It’s common in countries where traditional banking infrastructure developed late – they adopt newer technologies more readily.

Cultural Reflections in Currency

What I appreciate about Maldivian currency is how it functions as cultural ambassador. The designs aren’t random – they showcase Bodu Beru drums, traditional Dhoni boats, marine life, and historic landmarks. Each note teaches something about Maldivian identity.

Currency serves this educational role everywhere, but it feels more intentional in smaller nations. There’s a conscious effort to communicate “this is who we are” through the designs. Collectors notice this; it’s part of what makes world currency fascinating to study.

Challenges and Future Outlook

Climate change looms over everything in the Maldives. When your highest point is barely eight feet above sea level, rising oceans aren’t abstract concerns. This vulnerability affects currency stability indirectly – economic uncertainty always does.

The government is working to diversify beyond tourism, developing fisheries, agriculture, and tech sectors. These efforts matter for long-term currency stability. A more diverse economy means more resilience to shocks, whether from global pandemics, climate events, or tourism downturns.

For now, the Rufiyaa reflects both the Maldives’ achievements and challenges. It’s a small currency from a small nation, but it carries big responsibilities for the people who depend on it daily.

Recommended Collecting Supplies

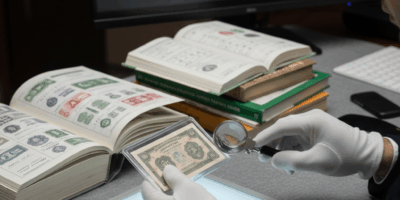

Coin Collection Book Holder Album – $9.99

312 pockets for coins of all sizes.

20x Magnifier Jewelry Loupe – $13.99

Essential tool for examining coins and stamps.

As an Amazon Associate, we earn from qualifying purchases.