Currency collection insurance has gotten complicated with all the coverage options and fine print that most collectors never bother reading. As someone who’s built and protected collections over the years, I learned everything there is to know about what happens when standard homeowner’s policies leave your $50,000 collection completely vulnerable.

Standard Insurance Falls Short

Probably should have led with this section, honestly. Homeowner’s and renter’s policies include coverage limitations for collectibles. Read your policy carefully—you’ll likely find specific caps on coins, currency, stamps, and similar items. These limits exist because standard policies can’t assess specialized collectibles accurately.

Even if your policy has higher limits, coverage often requires proof of value at the time of loss. Can you document what you owned and what it was worth? Without detailed inventories and appraisals, claims become disputes about value rather than straightforward replacements.

Standard policies typically cover actual cash value, not replacement cost. For collectibles, this distinction matters enormously. A note’s actual cash value might be calculated as purchase price minus depreciation—a formula that makes no sense for appreciating collectibles. Replacement cost coverage pays what you’d actually need to replace the item at current market prices.

What Specialized Coverage Offers

Dedicated collectibles insurers understand what they’re covering. Companies like Collectibles Insurance Services, Hugh Wood, and American Collectors Insurance specialize in coins, currency, stamps, and similar items. Their policies address collector needs that standard insurance ignores.

Specialized policies offer agreed-value coverage. You and the insurer agree on collection value when the policy starts. If total loss occurs, you receive the agreed amount without claim-time disputes about worth. That certainty exceeds what standard policies provide.

Coverage typically includes risks standard policies exclude. Mysterious disappearance (items that vanish without explanation), breakage during handling, and damage during travel often receive coverage. Collectors actively handling, displaying, and transporting material face risks that specialized policies address.

What This Actually Costs

Specialized collectibles insurance runs approximately $15-20 per $1,000 of value annually. A $50,000 collection costs roughly $750-1,000 per year to insure comprehensively. Larger collections often receive volume discounts; a $500,000 collection might cost $7,500-10,000 annually.

Compare this cost against potential loss. Would paying $1,000 annually to protect $50,000 in assets seem reasonable for any other investment? Insurance costs feel like wasted money until you need it—then it becomes the best money you ever spent.

Deductibles affect both premiums and claims. Higher deductibles reduce annual costs but mean more out-of-pocket expense if losses occur. Most collectors choose deductibles proportional to collection value—perhaps $250-500 for moderate collections, higher for major holdings.

Document Everything

Insurance claims require proof of ownership and value. Maintain detailed inventories listing every significant item with descriptions, catalog numbers, grades, acquisition dates, and costs. Photographs of individual notes document condition at the time of inventorying.

Professional appraisals support value claims. For significant collections, periodic appraisals from recognized experts establish current market values. These appraisals cost money but simplify claims and may be required by insurers for higher coverage amounts.

Here’s what most people miss: store documentation separately from the collection. If fire destroys your notes and your inventory records, claims become nearly impossible. Keep copies off-site—cloud storage, safe deposit box, relative’s home. The documentation survives the same disaster that destroys the collection.

Questions to Ask Your Insurer

Understand what triggers coverage. Policies define covered perils—the specific events that result in claim payment. All-risk policies cover everything except specifically excluded perils. Named-peril policies cover only listed events. All-risk provides broader protection despite typically higher costs.

Transit coverage protects notes during travel. Attending conventions, delivering sales, or moving between locations creates exposure. Ensure your policy covers transit—some basic policies cover only items at designated locations.

Ask about coverage during display. Notes exhibited at shows or loaned to museums may face different coverage rules than home storage. Clarify how your policy handles display situations before problems occur.

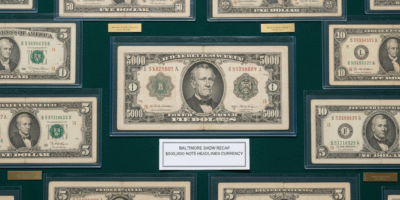

Working with Insurance Companies

That’s what makes specialized insurance endearing to serious collectors like us—provide accurate information when applying. Understating collection value saves premium costs but leaves you underinsured. Insurers may reduce claim payments proportionally if they discover understatement. Accurate declarations protect your interests despite higher premiums.

Update coverage as collections change. Annual policy reviews should reflect acquisitions, sales, and value changes. A collection that’s grown from $30,000 to $75,000 needs updated coverage. Don’t wait for losses to discover you’re underinsured.

Understand claim procedures before you need them. Know who to contact, what documentation to provide, and what timelines apply. Having this information ready before emergencies occur enables faster, smoother claims processing.

Prevention Still Matters

Insurance transfers financial risk but doesn’t prevent losses. Security measures—safes, alarm systems, careful storage location selection—reduce theft risk. Fire protection and climate control reduce environmental risks. Insurance works best as backup to active loss prevention.

Diversified storage locations limit catastrophic loss exposure. A collection split between home storage and bank safe deposit box can’t be completely destroyed by any single event. Geographic separation provides disaster resilience that insurance alone doesn’t provide.