Understanding Gold Coin Dealers Near Me

Finding a trustworthy gold coin dealer has gotten complicated with all the sketchy operators and online noise flying around. As someone who has spent more hours than I’d like to admit wandering through coin shops, comparing premiums, and learning the hard way which dealers deserve my business, I learned everything there is to know about finding reputable gold dealers. Today, I will share it all with you.

Here’s the thing — finding a good gold coin dealer isn’t just about who’s closest to your house. It’s about finding someone who won’t take advantage of what you don’t know. And in this business, what you don’t know can cost you a lot of money very quickly. I got burned exactly once by a questionable dealer early on, and that expensive lesson shaped how I approach every gold purchase today.

Why Invest in Gold Coins?

Here’s what still strikes me about gold after all these years of collecting: it’s one of the very few investments you can physically hold in your hand. During economic turbulence, when stock portfolios are doing stomach-churning drops and the talking heads on TV are panicking, there’s something genuinely reassuring about knowing you have physical metal locked away in a safe. That peace of mind is hard to put a dollar value on.

Gold coins specifically offer real advantages over bars or jewelry for most people. They’re easily divisible if you need to liquidate just a portion of your holdings. They’re widely recognized for their value pretty much anywhere in the world. And they often carry numismatic premiums beyond just their metal content — a fact that matters way more than many new investors realize when they’re starting out.

Types of Gold Coins

Probably should have led with this section, honestly. I remember being completely confused about coin categories when I first started buying gold. Nobody explained it clearly. Let me break this down the way I wish someone had laid it out for me back then.

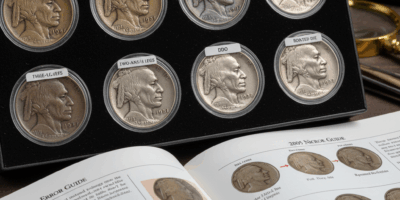

- Bullion Coins: These are priced primarily based on their gold content. Your American Eagles, Canadian Maple Leafs, and South African Krugerrands all fall in this category. They trade close to the spot price of gold with modest premiums on top. For pure investment purposes where you just want gold exposure, these are usually your best and simplest bet.

- Numismatic Coins: This is where collecting intersects with investing, and where things get really interesting to me. Historical significance, condition, and rarity can push prices far, far above the metal value alone. I’ve personally seen coins containing maybe $800 worth of gold sell for $15,000 because of what they represent historically. That premium is real and can grow over time.

- Commemorative Coins: These are often beautiful to look at but frequently poor investments. The premiums charged at initial issue rarely hold up when you try to sell them on the secondary market. Buy them if you genuinely love them aesthetically, but please don’t expect great investment returns. I learned this one the moderately expensive way.

Choosing a Gold Coin Dealer

After getting burned that one time by a dealer who talked a great game but sold me an overgraded piece at an inflated price, I developed criteria that I now apply to every single dealer interaction. No exceptions.

- Reputation: Check online reviews, absolutely, but also ask other collectors. The numismatic community is surprisingly tight-knit, almost like a small town, and word spreads fast about problematic dealers. If someone’s been ripping people off, the community knows about it.

- Certification: PNG (Professional Numismatists Guild) and ANA (American Numismatic Association) membership actually matters. These organizations require members to adhere to ethical standards and provide real recourse if things go sideways. It’s not a guarantee, but it’s a meaningful filter.

- Experience: Dealers who’ve been around for decades have built sourcing networks and relationships that newer operations can’t match. They also have reputations worth protecting, which gives you some built-in insurance. A dealer who’s been in business for thirty years isn’t going to risk that over one shady transaction.

- Service: Pay close attention to how they treat you when you’re just browsing and clearly not about to drop a lot of money. Good dealers educate you and seem genuinely happy to talk coins. Bad ones pressure you toward whatever has the highest margin. The difference is obvious once you know to look for it.

- Pricing: Compare the spread between their buy and sell prices. Wide spreads mean you’re paying more premium going in and getting less back when you eventually sell. Tight spreads indicate a dealer who’s competing on volume and relationships rather than gouging individual customers.

Where to Find Gold Coin Dealers?

Physical locations still matter for gold purchases, no matter what the online-only retailers might tell you. Here’s where I’ve had the best luck:

- Brick-and-Mortar Stores: I genuinely prefer seeing and holding coins before I hand over real money for them. You can inspect quality up close, discuss authenticity face to face, and sometimes negotiate when the vibe is right. That personal interaction has saved me from making mistakes on multiple occasions — catching problems that photos would never have shown.

- Coin Shows: These events pack dozens of dealers under one roof, and that’s when the magic happens. I’ve made some of my absolute best purchases at shows because the competition between dealers keeps prices honest and the selection is unmatched. If you’ve never been to a major coin show, you’re missing out.

- Pawnshops: Occasionally worthwhile, but tread carefully. Some pawnshops price gold fairly based on current spot; others are wildly off market value in either direction. It’s worth a look if you’re passing by, but go in with your guard up and your price knowledge fresh.

Online options have expanded dramatically in recent years, and I’d be lying if I said I don’t use them. But I approach online gold buying more cautiously than in-person transactions.

- Online Marketplaces: eBay can work if you are extremely careful about checking seller ratings, feedback history, and buyer protection policies. But I’ve seen way too many counterfeits on there to recommend it for anyone who’s still learning. The risk is real.

- Established Online Dealers: Major operations like APMEX, JM Bullion, and SD Bullion have built serious reputations that they actively protect. Pricing is transparent and published, authentication is guaranteed, and they have real customer service departments. For straightforward bullion purchases, these are hard to beat on convenience.

- Gold Exchanges: Platforms that connect buyers and sellers directly can sometimes offer better pricing, but they put more due diligence responsibility on you as the buyer. Know what you’re doing before you venture here.

Risks of Buying Gold Coins

I wish someone had sat me down and explained these pitfalls before I started spending real money. Would have saved me some painful lessons.

- Authenticity: Counterfeits have gotten disturbingly good in recent years. I now authenticate anything I buy over $500 regardless of the source, and I strongly recommend you do the same. The cost of authentication is tiny compared to the cost of getting stuck with a fake.

- Market Fluctuations: Gold isn’t as volatile as individual stocks, but prices absolutely do move. Don’t buy gold expecting quick profits — that’s not what it’s for. It’s a long-term hedge and a store of value, not a day-trading vehicle.

- Liquidity: Standard bullion coins sell quickly and easily, any day of the week. Numismatic pieces can take weeks or months to find the right buyer who’s willing to pay what the coin is actually worth. Plan your liquidity needs accordingly.

Storing Gold Coins

Security became a very real concern for me once my collection grew beyond what I’d call “casual.” At a certain point you’re holding enough value that you need to think seriously about this.

- Home Safes: Absolutely worth the investment, but only if you install them properly. Bolted to the floor, well hidden, and fire-rated. I’ve heard way too many horror stories from other collectors about safes being physically carried out of houses during burglaries because they weren’t secured properly.

- Safe Deposit Boxes: Very secure but not especially convenient. You can only access them during bank hours, and some banks actually have restrictions on storing precious metals. Check before you assume your bank is fine with it.

- Specialty Storage: Professional vault facilities designed specifically for precious metals often include insurance coverage and security measures that go way beyond what most of us can arrange on our own. For larger holdings, the annual fee is money well spent for the peace of mind.

Assessing Coin Value

That’s what makes gold coin collecting endearing to us numismatists — the valuation process itself teaches you something new every time. Here’s what factors into what a gold coin is worth:

- Gold Content: Weight and purity establish the absolute floor value. A one-ounce .999 fine coin has the same metal value no matter what’s stamped on the face. This is your starting point.

- Market Price: Track the spot price of gold. I check it daily, which my wife thinks is excessive, but knowing current values at all times prevents me from overpaying in the moment.

- Condition: For numismatic pieces, the grade is everything. A single point difference on the Sheldon grading scale can mean substantial — sometimes dramatic — price differences. The jump from MS-64 to MS-65 on certain coins can double the value.

- Rarity and Demand: Some coins command premiums that seem to defy logical explanation but prove remarkably consistent over time. Low mintage plus high collector demand equals high prices. It’s simple supply and demand, but the specifics take years to learn.

Insurance for Gold Coins

Once your collection reaches significant value, insurance isn’t optional anymore. It’s a necessity.

- Homeowners Insurance: Your existing policy usually includes some coverage for valuables, but the limits are often laughably low for any serious collection. I was shocked when I checked mine and found the cap. Read your policy carefully before assuming you’re covered.

- Specialized Insurance: Companies like Collectibles Insurance Services offer policies built specifically for precious metals and numismatic collections. The coverage is more comprehensive, the premiums are reasonable relative to what you’re protecting, and claims handling is generally much smoother because they understand what they’re insuring.

Tax Implications

Nobody’s favorite topic, I know. But ignoring taxes on gold transactions creates problems that are much worse than just dealing with them upfront.

- Capital Gains: Selling coins at a profit triggers tax liability. Gold is classified as a collectible by the IRS, which means it can be subject to higher capital gains rates than standard investments in some situations. Keep records of what you paid for everything — you’ll thank yourself later.

- Sales Tax: This varies enormously by state. Some states exempt bullion entirely; others tax everything including bars and coins. Know your local rules before making significant purchases so you can factor the tax into your total cost.

Building a Gold Coin Portfolio

Diversification applies to coin collecting just like it does to any other investment strategy. Don’t put all your eggs in one basket, as they say.

- Mix Types: Combine bullion coins for pure, straightforward metal exposure with numismatic pieces that offer potential appreciation beyond just the gold content. Each serves a different purpose in your overall portfolio.

- International Variety: Coins from different countries give you exposure to various markets and often showcase completely different aesthetic traditions. My collection includes pieces from a dozen countries, and each tells a different story.

- Historical Range: Older coins bring numismatic interest and historical connection while modern issues provide reliable, easily verified bullion value. Having both gives your collection depth and flexibility.

The Future of Gold Coin Investment

Gold’s role in investment portfolios isn’t going away anytime soon. Economic uncertainty tends to drive renewed interest in physical precious metals, and there’s certainly no shortage of uncertainty in the world lately. Whether you’re just starting to build your first collection or expanding one you’ve been growing for years, the key comes down to two things: finding dealers you genuinely trust and building your knowledge base steadily over time. Get those two things right, and the rest tends to follow naturally.

Recommended Collecting Supplies

Coin Collection Book Holder Album – $9.99

312 pockets for coins of all sizes.

20x Magnifier Jewelry Loupe – $13.99

Essential tool for examining coins and stamps.

As an Amazon Associate, we earn from qualifying purchases.