Coinflation and Hidden Wealth

Coin melt values have gotten complicated with all the fluctuating metal prices and composition changes over the years. As someone who tracks these numbers regularly, I learned everything there is to know about when your coins are worth more melted than spent. Today, I will share it all with you.

What Coinflation Actually Means

Coinflation refers to the current melt value of a coin—what the metal inside it would sell for if you extracted and sold it. When metal prices rise high enough, coins become worth more as raw material than as currency. This creates interesting situations for collectors and investors who pay attention to these values.

Why Metal Content Matters

Probably should have led with this section, honestly. Different coins contain different metals in varying amounts. Gold and silver coins obviously carry significant metal value. But even common coins like pre-1982 pennies (95% copper) and pre-1965 quarters (90% silver) can exceed their face value based purely on metal content.

The Silver American Eagle provides a clear example. Its face value is one dollar, but the silver content makes it worth many times that amount. This gap between face value and metal value drives much of the interest in coinflation tracking.

Economic Effects

That’s what makes coinflation endearing to us economics nerds—it forces real policy responses. When silver prices spiked in the 1960s, the U.S. Mint changed coin compositions from 90% silver to copper-nickel. The alternative was people melting coins for profit, which would have created coin shortages.

Similar composition changes happened with pennies in 1982 (copper to zinc) when copper prices made pennies cost more to produce than they were worth. These policy decisions reflect the ongoing tension between coin face value and metal value.

What Drives Metal Prices

- Supply and Demand: Basic economics applies. Increased industrial demand for silver or copper raises prices. New mine production or recycling increases supply. These forces constantly shift coinflation values.

- Global Events: Trade disputes, political instability, and economic uncertainty affect precious metal prices. During turbulent times, investors often move toward gold and silver, driving prices upward.

- Economic Conditions: Inflation fears, currency concerns, and interest rate changes all influence precious metal markets. Coins with significant metal content reflect these broader economic forces.

Practical Applications

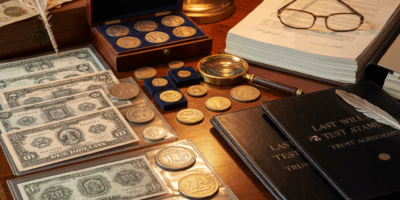

Collectors use coinflation to understand the baseline value of their holdings. A box of old silver quarters might look unimpressive, but the metal value could be substantial. Knowing this helps with insurance decisions and sales pricing.

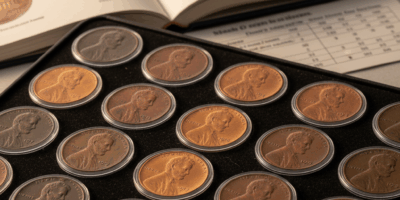

Investors track coinflation for profit opportunities. When metal prices rise, certain coin types become more valuable. Some people specifically collect pre-1965 silver coins or pre-1982 copper pennies as a form of precious metals investment.

Tracking Resources

Websites like coinflation.com calculate current melt values based on spot metal prices. These tools let you input what you have and see current metal values. The calculations update with market prices, giving you real-time information about your collection’s baseline worth.

Understanding coinflation adds a dimension to coin collecting beyond historical interest and condition grading. It connects your coins to global commodity markets and monetary policy in ways that reveal the hidden economics behind everyday currency.

Recommended Collecting Supplies

Coin Collection Book Holder Album – $9.99

312 pockets for coins of all sizes.

20x Magnifier Jewelry Loupe – $13.99

Essential tool for examining coins and stamps.

As an Amazon Associate, we earn from qualifying purchases.